Seed funding for startups

Financing Options

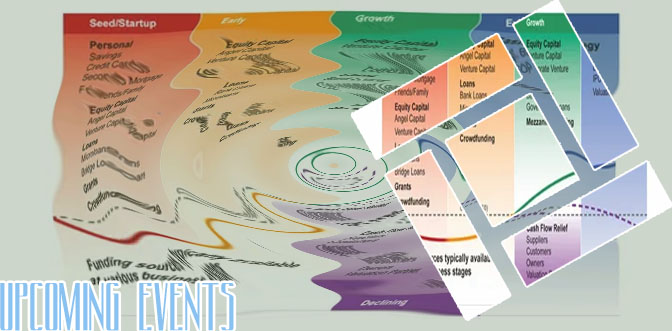

Series A Funding can raise capital between $2-15 million dollars, which is a noticeable increase from the $500,000-$2,000,000 range typical of seed funding. Need seed funding Sometimes your new business venture needs a lift to get off the ground. If you can’t generate much revenue yet, you might start considering seed funding for startups. Seed funding is the first official round of startup financing for many businesses. It’s also the first time the owners have to make firm decisions about the following:

Get seed funding for startup

DigitalOcean provides founders a variety of resources through Hatch, our global startup program. Sign up to learn how we can help you build and grow your startup through intelligent infrastructure solutions. When to start raising pre-seed funding First and foremost, you can’t just come and get money. You need to go through several phases called rounds to prove that your idea deserves investment. Each funding round is made to accumulate enough capital to grow the startup and can take from 3 months to a year. Let’s discuss the core stages of startup fundraising.

Is seed funding right for you?

Seed funding, also called seed money or seed capital, is the initial investment a startup requires to start its operations or to launch itself as a full-fledged business. Understanding seed funding After your company is turning a profit, if additional funding is needed, Series B financing can take place. Series B funding is used to increase production, to execute a marketing plan and to compete head-on with competitors. During this stage, the criteria for funding is evaluating the profit forecasts, how your company stacks up against its main competition, and whether intellectual property is involved and if so, its value in the marketplace. The funding limits are higher than Series A, but the risks are lower.

Seed start up

The typical number of seed rounds that a company goes through before completing an initial public offering (IPO) is three. However, there is no set number of rounds that must be raised. Startup Accelerator Spotlight: Alchemist Accelerator Startup funding should be based on milestones. This means that before starting to pitch for funds, founders should have a plan that helps them visualize the size of funds to be raised at various stages during the startup lifecycle. Thus the size of seed funding should be small, only to be increased organically over the years. From the investor’s point of view, this approach works as well owing to the nascent nature of the business. It is logical to invest larger funds only after the startup has started to generate revenues and gathered commendable traction among customers.

|