Calculate return on investment

Limitations of ROI

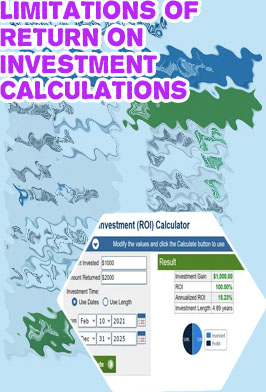

As these variations show, the ROI calculation can be varied significantly to measure different types of returns and can be manipulated by the adjustments. When using this calculation, you should be aware of what you are trying to measure. When using it for comparison purposes, you must ensure that all measurements are calculated on the same basis. Net return on investment formula Written by MasterClass

Roi return on investment formula

There are multiple methods for calculating ROI. The most common is net income divided by the total cost of the investment, or ROI = Net income / Cost of investment x 100. Restaurant ROI Calculator | How to Calculate ROI for Restaurants ROI takes an investment view, and is typically used for financial decisions where a company can compare different projects and the effectiveness of the different investments. It is an indication to the investor of the holistic growth of an investment from start to finish, by taking the cash flow streams following an action. What makes ROI so popular is that it provides an easy and direct method to compare net gains to costs of an investment.

How to Calculate ROI in Sales

Another possible method to calculate ROI is investment gain divided by investment base, or ROI = Investment gain / Investment base. There are numerous other ways to calculate ROI, so when discussing or comparing ROIs between departments or businesses, it is important to clarify which equation was used to determine the percentage. Each equation may measure a specific set of investments. ROI is shown as a percentage instead of a ratio for ease of understanding. How to use NerdWallet’s investment return calculator: Investment length gives the compounding effect more time to work its magic. The longer the time invested, the more the total return from the investment can increase. This means that investments with longer investment horizons can be more profitable than those with shorter ones, even if the initial investment and other variables are the same.

Return on investment calculation

Return on Investment (or ROI) is a FINANCIAL metric to evaluate the profitability of an investment. It tells you how much net income (“new money” from savings or from the realization of some benefit) you can generate from an investment (typically in a project to implement a new process, some new infrastructure, a new piece of software, etc.). Living on Campus An efficient marketing campaign may result in a cost ratio of 5:1—that is, $5 generated for every $1 spent, with a simple marketing ROI of 400%. An excellent campaign might see a cost ratio of $10 generated for every dollar spent (10:1) with a simple marketing ROI of 900%.

|