Balance sheet accounts

Practice

The way you do things could be just as valuable as anything you sell. You won’t find that as an asset on the balance sheet. Ask the folks at McDonald’s how they consistently deliver the same hamburger everywhere you go. Those processes account for much of the cost of entry for new franchisees. Accounts under balance sheet While different roles will examine the balance sheet report for different reasons and insights, there is a general way to interpret it. What’s essential to understand is that the sheet accounts must always balance each other out.

Balance sheet position

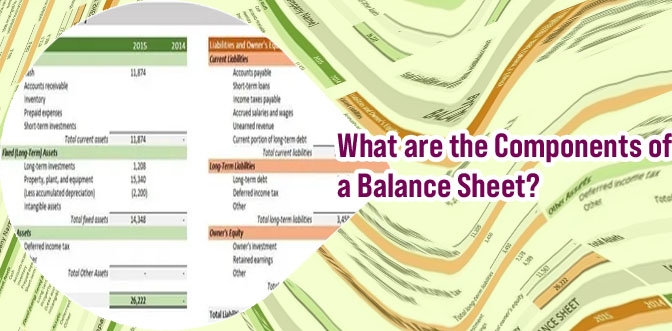

The Balance Sheet lists your company's assets, liabilities, and equity. Business financing - Revolving Not sure how to create a balance sheet? Below, we’ll delve into the purpose of creating balance sheets (also known as net worth statements) and then provide a step-by-step guide of how to make your own.

Run a Balance Sheet report in QuickBooks Online

In the last blog post we talked about how to set up proper Profit and Loss categories for the chart of accounts. In this post we will continue our discussion with a look at balance sheet accounts and how to think about assets, liabilities, and equity accounts. How the Balance Sheet Works There are also accounting estimates reflected on the balance sheet. While required in order to have financial statements that conform with GAAP (Generally Accepted Accounting Principles), these estimated adjustments do not always equate to market value at liquidation.

Financial accounting balance sheet

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders’ equity. Balance sheets show what a company owns and what it owes at a fixed point in time. Income statements show how much money a company made and spent over a period of time. Cash flow statements show the exchange of money between a company and the outside world also over a period of time. The fourth financial statement, called a “statement of shareholders’ equity,” shows changes in the interests of the company’s shareholders over time. On the Balance Sheet: Assets, Liabilities & Equity In addition to a vertical analysis, another way to parse your balance sheet is with a classified balance sheet. A classified balance sheet is a breakdown of each of your balance sheet’s subcategories, creating a more nuanced and valuable report. There are no specific or standardized groupings of subcategories. Instead, your financial management team can decide what classifications are best to use for your short-term and long-term goals.

|