Private placement

Private Placements Types

Greenstone’s local presence allows it to continuously expand its deep-rooted, long-term relationships with over 1,700 local investment organizations to form highly targeted placement engagements for each fund manager with whom it partners. Currently, Greenstone’s relationships include the region’s largest sovereign wealth funds, over 200 GCC-based mid-tier institutional investors, over 1,500 local family offices and UHNWIs, and numerous PWM-distribution channel partners. Private placement funds 2. Common Requirements Applicable to Regulation D Private Placements

Private placement stock

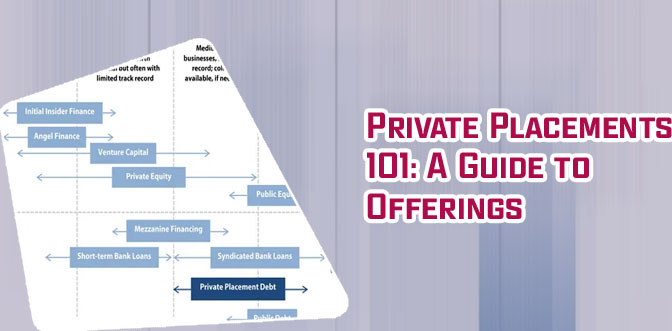

The meaning of private placement could be better understood by exploring the types of such distributions found in the market. Preferential allotment and qualified institutional placement are the two significant types of it. Advantages of Private Placement The gross proceeds from the private placement were approximately $25 million before deducting the placement agent fees and other offering expenses payable by the Company. The Company intends to use the net proceeds from this offering for general corporate purposes, including working capital.

How Private Equity Works: A Primer

Each Fund is a speculative investment that involves a high degree of risk and uncertainty, and is not suitable for investors who cannot afford to lose their entire investment. There is also no guarantee that any of the Funds will meet their respective investment objectives. Requirement for Private Placement of Shares U.S. Securities and Exchange Commission. "Private Placements - Rule 506(b)."

Private placement of shares

(ii) “private placement” means any offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) through issue of a private placement offer letter and which satisfies the conditions specified in this section. FINRA Utility Menu Morgan Stanley is a full-service securities firm engaged in a wide range of financial services including, for example, securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services. Morgan Stanley Investment Management is the asset management division of Morgan Stanley.

|