Bcg private equity

Your symbols have been updated

Pain relief for CFOs through financial consulting & technology advisory Private equity partners Our companies manufacture highly engineered products with mission critical applications that create a healthier and more secure future.

Private equity technology

Https://evermore.industries/ - Evermore companies generally fit the following criteria, Revenues of $4M-$50M, EBITDA of $1M-$5M, 10+ years of operating history. Justin Vogt & Edward Redden. Why marketing is often underfunded Private-equity backers of tech companies say they have intensified their focus on controlling costs in the face of higher interest rates and an uncertain macroeconomic outlook, industry advisers say. Still, executives at tech-focused private-equity firms say there’s much to like about the sector, particularly software, largely seen as one of the most inflation-protected assets because it helps companies cut costs and increase productivity.

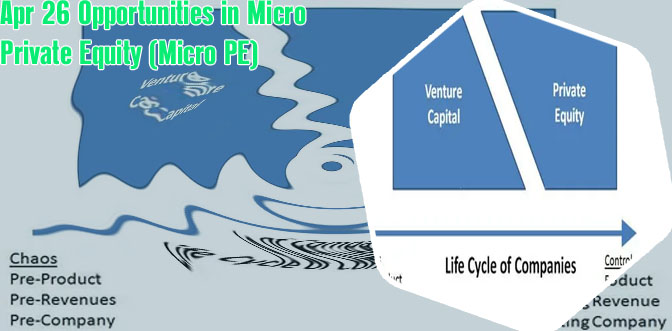

The Promise for Private Equity

Thank you for visiting our Website. Please contact us at [email protected] if you have any questions about our Website or these Terms and Conditions. INBOUND MARKETING When it comes to generating new opportunities, private capital is at the forefront. For instance, investors and firms are strongly positioned to deliver material impact on environmental, social, and governance (ESG) priorities and to create value by accelerating digital transformation. BCG’s private equity services bring unique expertise to help investors and firms capitalize on opportunities while navigating uncertainties. Private equity marketing

In 2021, it was rare to see a seller standing behind company representations and warranties in a deal with a transaction size over $500 million, with the buyer instead self-insuring or relying on third-party representation and warranty insurance. In the seller-friendly 2021 market, this trend trickled down into the middle market, and we saw a number of transactions valued between $50 million to $500 million following suit. Partnership Monument MicroCap Partners, LLC (MMP) is an independent private investment firm comprised of highly experienced and accomplished private equity and operational executives seeking to sponsor the acquisition of companies in the MicroCap Market, which we define as businesses having EBITDA of $2-8 million. Our focus is on businesses located in the United States and Canada.

|